Which Interior Design Style Adds the Most Value to Your Home?

Speak to an expert advisor

Get Started

Mortgages

Increase your chance of mortgage approval with expert advice from a specialist broker. Whether you need help remortgaging, you’re self employed or even if you have bad credit, we’ve got you covered.

- No impact on credit score

- Mortgage Approval Guarantee

- Personally matched with an expert

Pensions

We work with independent Pensions Advisors who can help you get the most out of your golden years by finding the best deals for your needs and circumstances. Get expert advice from a dedicated Pensions Expert

- Professional pensions advisors

- Free and unbiased advice

- Personally matched with an expert

Savings & Investments

Get the right advice first time, whether you want to get the most out of your savings, or you want to invest your money elsewhere get expert advice from a financial expert.

- Savings and investments specialists

- Free and unbiased advice

- Personally matched with an expert

Insurance

Whether it’s protecting your home, covering your car or providing a safety net for you on your travels, insurance has your back. Get expert from advice from an insurance and protection advisor.

- Insurance and protection experts

- Free and unbiased advice

- Personally matched with an expert

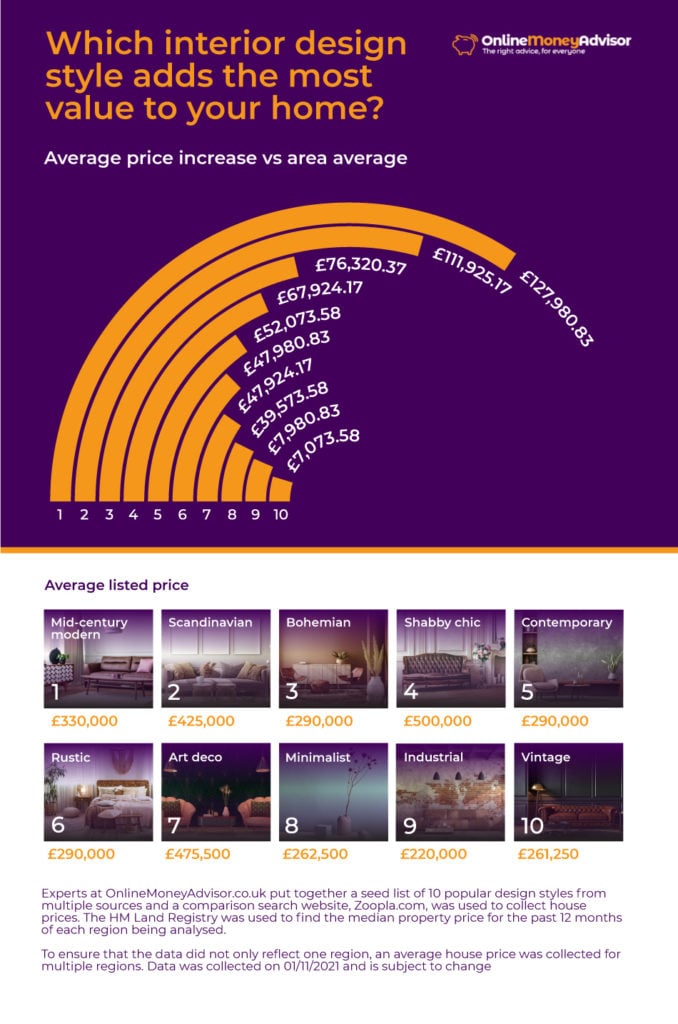

Most of us love to decorate in line with the latest trends in interior design, whether it's Scandinavian-inspired, vintage, or shabby chic. During the excitement of the redecorating process, you probably wouldn’t usually consider whether your choice of interior design style could affect the total value of your home.

In this study, Online Money Advisor has analysed 10 of the most popular design styles and hundreds of Zoopla property prices in various regions to determine which interior design style adds the most value to your home and give you some inspiration.

How to increase property value using different interior designs

1. Mid-century modern

If you want to add the most value to your home, consider clean lines, lots of organic shapes, and minimalist adornment. This type of interior decorating is categorised as mid-century modern and can add £127,980.83 to your asking price, with the average listed price throughout the UK for this style sitting at £330,000.

If you’re in Leeds, start looking for mid-century modern furniture now as properties listed with this style have an average price of £369,975, which is more than £162,048 than other houses in the area.

2. Scandinavian

The influence of IKEA in the UK has definitely spilled over into our own decorating taste, and when it comes to increasing the value of your home, Scandinavian style is one of the best trends to follow. With this blend of minimalism, textures, and soft hues, the average property price is £425,000, a value increase of just over £111,925 compared to houses without this style. This leap in value is particularly noticeable in Liverpool, where you can expect the listed price to be over £162,162 more than houses without this décor.

3. Bohemian

In bohemian style, layering patterns, textures, and colours are more important than having a strict structure. It's personal and relaxed; the boho style is not intended for others but the decorator themselves. However, this personal style doesn’t mean this type of interior design won’t affect your house value. Bohemian homes are listed for £76,320 more than other properties in the area with different interior design styles, on average, throughout the UK.

Regionally, the value increase is most noticeable in London. The average house price in the capital is £498,223, but boho-style homes are typically listed for £1,690,000!

4. Shabby chic

Shabby chic interior design is often thought of as cost-effective and low maintenance. This type of decorating usually includes neutral backgrounds, weathered furniture and a mix of eras. This style can add over £67,924 to your asking price on average compared to other houses in the area with different interior design styles, and has a typical listed price of £500,000.

People in Leeds are most likely to pay more for houses with a touch of shabby chic as this style can fetch £687,073 more than others in the city.

5. Contemporary

The character of contemporary interior design is understated sophistication, deliberate use of texture, and plenty of clean lines. It tends to highlight space rather than objects. And what can you expect when decorating in this style? An average of £52,073 added to your house value!

If you’re in Birmingham and a fan of contemporary decoration, you’re in luck! Properties without this style of interior design are often listed for £237,924 less than houses with it.

6. Rustic

Rustic interior design is characterised by natural materials, rough textures, and an aged appearance. A no-fuss aesthetic is not only a great way to present your home's natural appeal and warmth, but can also increase its value substantially.

An average asking price in the UK of a home with rustic interior design is £290,000, with this style of decorating typically adding over £47,980 in value versus other houses in the UK.

7. Art deco

Featuring rich colours, walls with bold geometric shapes, and masses of detail, art deco was the most popular interior design from the 1920s to 1940s. In addition to bringing in glamour and luxury to your home, it can also increase your property value by over £47,924 when compared with other houses in the area with different interior design styles.

Properties in Leeds have an average listing price of £207,926, but if your home is decorated in an art deco style, it could be worth around £500,000. That’s a healthy increase of £292,073.

8. Minimalist

Using the bare necessities to create a simple and uncluttered environment is what minimalist interior design is all about. A monochromatic palette is often used to achieve this kind of style, which seems to be a hit with buyers as £39,573 more is added to the listed price with this interior design style.

The average asking price in the UK for a home with minimalist interior design is £262,500 and you can find plenty of them in Manchester and London.

9. Industrial

Metal piping and exposed brickwork are common architectural features of industrial interior design. This raw look means there is a casual atmosphere throughout your home, which is highly sought after in many areas of the UK. The price increase compared to the average throughout the UK is over £7,980.

Brummies are particular fans of this industrial style, perhaps due to their history as a ‘city with a thousand trades’. While the average house price is £202,076, properties with industrial tones are more likely to be listed for around £269,995 – an increase of £67,919!

10. Vintage

The vintage style is quite popular and reflects what glamour and elegance was like back in the 1940s. Decorating your house with vintage interior design is something you most likely won’t regret, as it can add £7,073 to the property’s value.

A home with vintage interior design is typically listed for £261,249 in the UK, with this style most prevalent in Birmingham and Leeds.

If you’re looking to move and are interested in different investment choices, take a look at our comprehensive guide to SIPPs.

Methodology:

- Experts at OnlineMoneyAdvisor.co.uk wanted to find out which interior design style adds the most value to a home.

- To do so, a comprehensive seed list was created of 10 popular design styles from multiple sources, including luxdeco.com, Rochelledecorating.com, and CountryLiving.com.

- Property and comparison search website Zoopla.com was used to collect house prices.

- To ensure that the data did not only reflect one region, an average house price was collected for multiple regions.

- For each region, the interior design style was inputted in the “keywords” section of the Zoopla search function and the median house price value was taken.

- The HM Land Registry was used to find the median property price for the past 12 months of each region being analysed.

- The results were then combined to create a median overall increase/decrease per interior design style.

- The styles were ranked from highest to lowest increase.

- Data was collected on 01/11/2021 and is subject to change.

FCA Disclaimer

*Based on our research, the content contained in this article is accurate as of the most recent time of writing. Lender criteria and policies change regularly so speak to one of the advisors we work with to confirm the most accurate up to date information. The information on the site is not tailored advice to each individual reader, and as such does not constitute financial advice. All advisors working with us are fully qualified to provide mortgage advice and work only for firms that are authorised and regulated by the Financial Conduct Authority. They will offer any advice specific to you and your needs.

Some types of buy to let mortgages are not regulated by the FCA. Think carefully before securing other debts against your home. As a mortgage is secured against your home, it may be repossessed if you do not keep up with repayments on your mortgage. Equity released from your home will also be secured against it.